Adani is an Indian mining and energy company seeking to build the world's biggest new coal mine in central Queensland's Galilee Basin -- the Carmichael mine.

Adani's Carmichael coal mine has become notorious for its sheer scale, and for the damage it will cause to the Great Barrier Reef, to vast quantities of groundwater, to the world's climate, and to threatened species.

But the project's proponent is also fast becoming one of the most controversial companies in the world.

Adani has a documented history of corruption, bribery, and human rights abuses across the world. It's currently facing further criminal investigations for alleged involvement in multi-billion dollar fraud in India.

Despite Adani's appalling track record, the mine's unpopularity, and its enormous environmental and social impacts, Australian Queensland and Federal governments continue to support the Adani project.

Malcolm Turnbull's Federal Government is now preparing to give Adani a $1 billion taxpayer-subsidised loan to build a rail line from the mine site to the associated coal port, Abbot Point. Polling shows 74.4% of Australians oppose public money being used in this way.

This report brings together new and previously documented evidence that shows Adani are, at their core, a dangerous, criminal organisation, not a viable proponent to be trusted with one of the most environmentally destructive projects in Australian history.

Adani's corporate structure is deliberately convoluted and opaque. There are 26 Adani subsidiaries registered in Australia, 13 of which are ultimately owned through the Cayman Islands.

Many of the incidents, criminal charges and allegations outlined in this report involve various Adani subsidiaries. For this report, we'll refer to them all simply as Adani.

If you are interested in finding out more about which particular Adani entity is culpable for, or stands accused of, the various crimes detailed in this report, please click here to download a detailed legal research briefing from Environmental Justice Australia and Earthjustice.

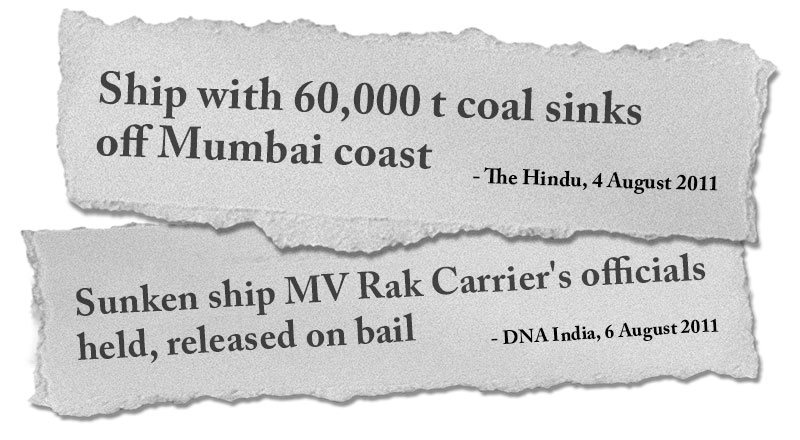

Adani's sunken coal ship devastates tourism, beaches and marine life

In 2011, an unseaworthy Adani coal ship sank off the coast of Mumbai, causing a massive oil spill and spilling 60,054 metric tonnes of coal into the ocean. Adani did nothing to clean up the mess for five years, as the spill destroyed mangroves, polluted beaches, and caused serious damage to the local marine environment and Mumbai's tourism industry.

In 2016 Adani and others were found liable for the spill and for failing to clean it up, and were fined the equivalent of AU $975 000.

The consignment of 60054 MT of coal has caused marine pollution and continues to be a cause and concern for environmental pollution. The Respondents are defaulting entities which have not complied with law and have adopted a most careless and reckless attitude in relation to protecting the marine environment.

-Key finding of the National Green Tribunal's judgement

RISKS FOR AUSTRALIA

With this record of complete disregard for marine protection, Adani's plan to ship 60 million tonnes of coal through the fragile Great Barrier Reef World Heritage area every year is of serious concern. Especially given the current lack of an emergency response plan for coal ship groundings, as demonstrated by the Shen Neng 1 coal ship, which has still not been cleaned up six years later.

Adani break the law to destroy environment in Mundra

"Irreversible and irreparable damage has been done to the area by the Adani Port and it is difficult to monitor the extent of the damage today. The mangroves have been destroyed and it has created an environmental disaster. …The fisherfolk and common people affected by this degradation cannot fight such a big company."

-Mahesh Pandya, an Ahmedabad-based environmentalist.

In the coastal town of Mundra in India, Adani operates one of the world's largest coal-fired power plants. Investigations of the Mundra project by Indian officials, independent committees and documentary film crews reveal a record of environmental destruction, harm to local communities, and a failure to comply with environmental regulation and development permits.

Adani illegally cleared 75 hectares of protected mangroves, flattened sand dunes, dredged the ocean, and blocked waterways. These activities created a diminished and diseased fish population, turned the groundwater saline, and flooded a village.

The outcome for the local villagers was catastrophic. Having traditionally relied on fishing and farming to survive, they are now left with barren land and oceans -- their fish stocks decimated.

Villagers reported Adani using bribery and intimidation to silence anyone who tried to challenge them. [1]

RISKS FOR AUSTRALIA

The destruction in Mundra, and Adani's flagrant violation of environmental law, stands as a stark warning of what Australia could face if we allow Adani to operate through the Great Barrier Reef and drain 12b litres of groundwater every year.

[1] Activist videos take on environmental track record of Adani mining company, Sydney Morning Herald, 3 March 2015

Adani's Australian CEO oversaw Zambian pollution disaster, then hid it from Australian authorities

In 2010, Adani's Australian CEO -- Jeyakumar Janakaraj -- was Director of Operations at Konkola Copper Mines ('KCM') in Zambia. He was "responsible for overall operations" when the company caused a major pollution disaster that poisoned the Kafue River -- the lifeblood for much of Zambia's people.

KCM discharged 'pregnant liquor solution' -- highly acidic, metal-laden water generated from leaching in copper mining -- into the river, which caused the river to change colour. Villagers who used to rely on the river for cooking, cleaning and bathing now say that, because of the pollution, people have become sick and died, the soil is barren, and the water smells foul and is orange-coloured. 1,800 Zambian villagers have filed a lawsuit against KCM to recover damages.

In November 2010, the Government of Zambia brought a successful criminal prosecution against KCM for this pollution and the harm it caused.

Adani failed to disclose this incident when applying for approvals for the Carmichael mine, as required under Australian law.

"I used to grow cabbages, potatoes, tomatoes and bananas, but now, there's no future here, only poverty and suffering because this land is damaged and spoilt."

- Leo Mulenga, an affected farmer

RISKS FOR AUSTRALIA

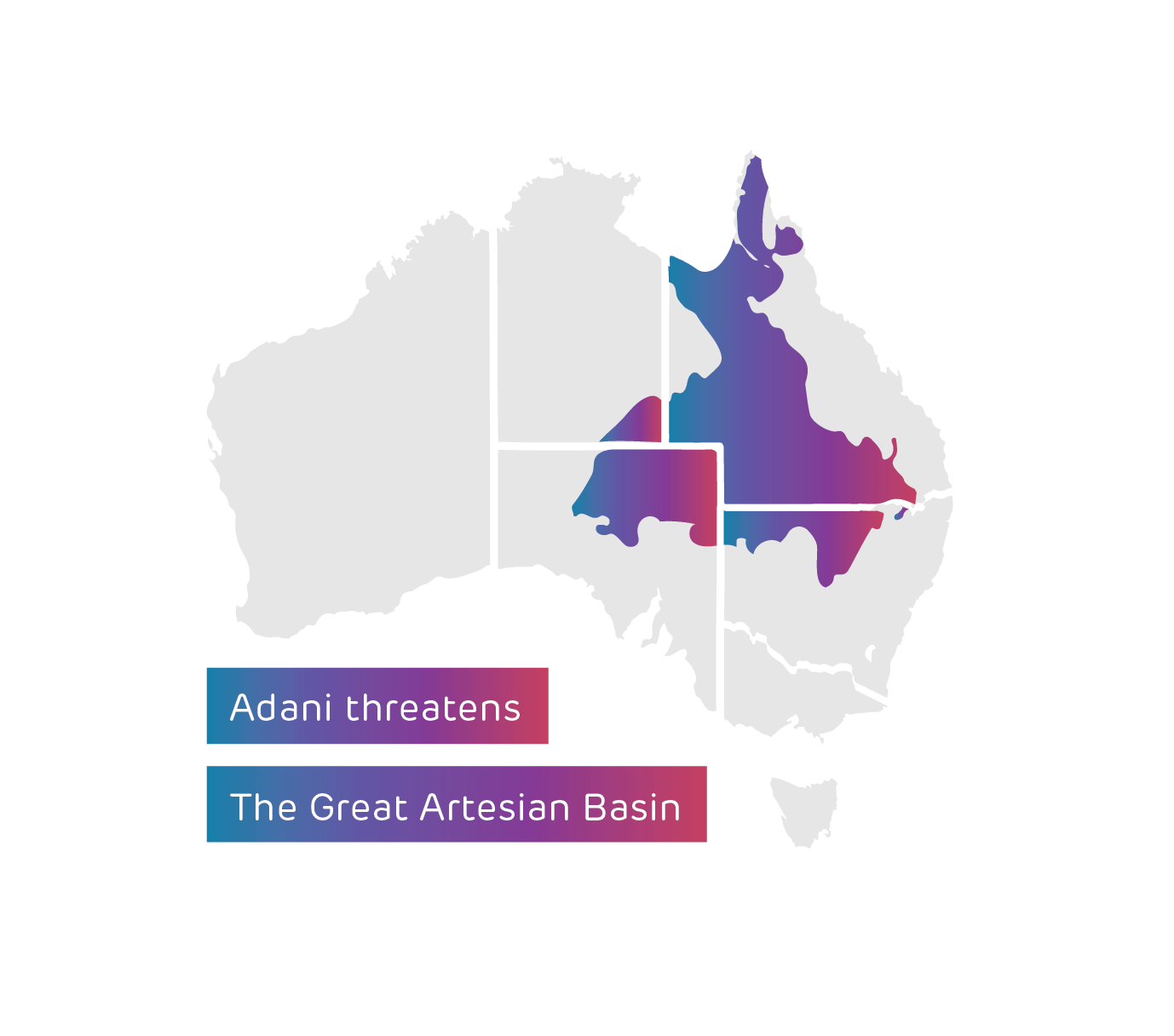

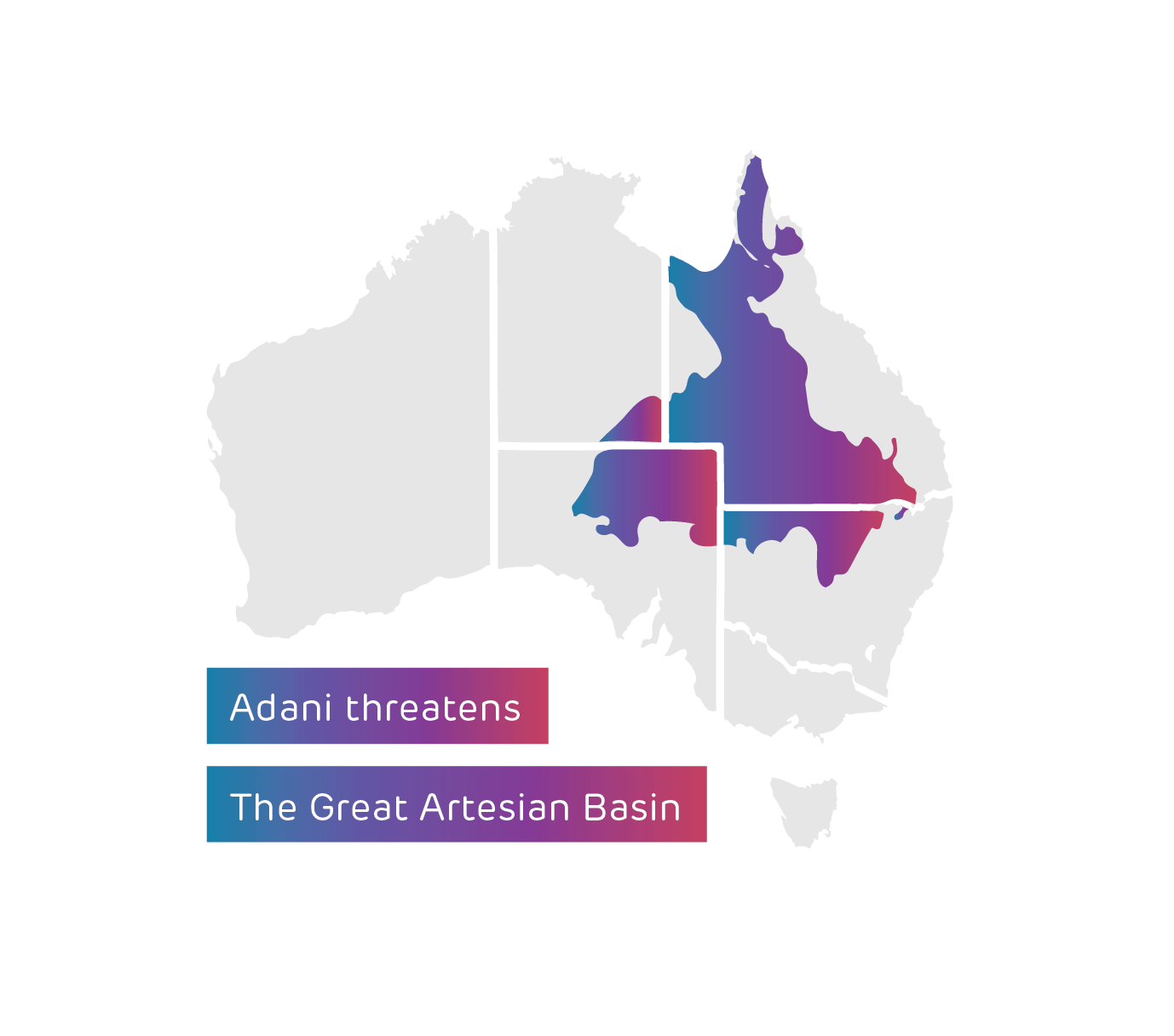

Mining in the Galilee Basin will have a significant impact on the Carmichael and Belyando rivers, and the Great Artesian Basin -- the sole water source for towns and farms across almost a quarter of Australia. Adani's plans to drain 297 billion litres of groundwater over the lifetime of the Carmichael mine will have long-term impacts on aquifers and presents a huge risk to farmers and other people who rely on that water to survive.[2]

[2] Draining the lifeblood: the impact of Galilee Basin coal mining on groundwater resources

Adani deprive 80 families of access to their fishing grounds at Hazira Port

Adani had no approval to begin work at their Hazira Port when they started illegally wiping out mangroves and claiming land. They blocked access to traditional fishing areas for 80 fishing families from the village of Hajira. Further, they destroyed mangroves and allegedly destroyed the habitat of a critically endangered bird species.

In January 2016 Adani was ordered to pay $4.8 million AUD for compensation and restoration and had their environmental approval revoked.

Threats and police intimidation in land grab

Media reports from India reveal Adani is using police intimidation, bribery and threats to dispossess people of their land in Jharkhand -- where the company want to build two power plants.

Villagers and government officials say the Jharkhand Government has deliberately undervalued local villagers' land to allow Adani to acquire the land at a fraction of the land's real value. One legislator raised the issue in state assembly, contending landowners are expected to receive about one tenth of the value of their land.

Community meetings on the sale of the land have been surrounded by a heavy-handed, intimidating police presence.[3] [4]

[3] Jharkhand government reduced land price to help Adani: Opposition, Business Standard, 8 March 2016

[4] Jharkhand: As BJP regime flouts norms to help Adani get land, media stays silent, Catch News, 13 December 2016

Take ActionBribery and illegal exports

Adani engaged in broad-ranging bribery to conceal the illegal export of 7.7 million tonnes of iron ore. In 2011, the Ombudsman of the Indian state of Karnataka investigated the corruption, and discovered a staggering scale of bribery.

Adani had bribed:

the police,

local politicians,

customs officials,

the State Pollution Control Board,

the Port Department,

the Weight and Measurement Department,

in return for facilitating and hiding their illegal exports.

Also, Adani routinely accepted iron ore from traders who were not permitted to supply the ore. The Ombudsman concluded that this scam, in which Adani was a major player, resulted in the illegal export of around 7.7 million tonnes of ore between 2006 to 2010.

'Black money'

Like big power companies in Australia, Adani are perfectly happy to screw their customers to inflate their profits. They lied about the cost of imported coal and equipment in order to evade tax and trick regulators into letting them charge Indian consumers much higher prices for their coal-fired power. Their gas supply arm was also found guilty of abusing its market power to overcharge its customers. Adani even colluded with a state power company to drive up prices in the midst of a power shortage crisis.

Six Adani Group companies are under investigation for lying about the quality and, hence value, of coal imported from Indonesia, allowing them to get away with charging higher prices, demanding public handouts, and driving up costs for Indian electricity customers. There is solid evidence that they've already ripped off their customers to the tune of over $200 million AUD.

Adani is also under investigation for a billion-dollar fraud, exaggerating the value of equipment imports into India by over 60%. Adani allegedly used an offshore holding company in Mauritius to siphon off much of the extra money from inflated invoices.

The Mauritius holding company is managed by Vinod Shantilal Adani, the older brother of Gautam Adani, and Chairman of the Adani group. Vinod is the sole director of a number of Singapore companies that own Adani subsidiaries in Australia. These companies are ultimately owned by a company registered in the Cayman Islands.

…evidence gathered suggests that the total value declared for the goods imported was Rs 9,048.8 crore ($1.7 billion AUD) whereas the actual value was Rs 3,580.8 crore; a difference of Rs 5,468 crore which has been siphoned ($1.07 billion AUD).

Mate's rates - undue benefit from political connections

Adani chairman Gautam Adani and Indian Prime Minister Narendra Modi are old friends. Modi even travelled in an Adani-branded private jet during his election campaign. And it turns out Adani isn't afraid of calling in favours.

While Modi was Chief Minister of Gujarat, Adani acquired vast swathes of land from farmers and locals in Mundra at a fraction of market value. It left locals across 14 villages dispossessed, and Adani clear to start construction.

Media reports revealed that the government sold 14,305 acres of land at Mundra to Adani at between 1 and 32 rupees per square metre (between 3 and 60 cents AUD), far less than offered to companies doing comparable projects.

Further, the Comptroller and Auditor General of India found that two pieces of forest land (1,840 hectare and 168.42 hectare) had been incorrectly classified, resulting in yet another undue benefit to Adani.

Price-gouging energy customers during power shortages

In 2013, the people of Gujarat were suffering from power shortages. At the same time, Adani was colluding with the local power authority to gouge prices and rip people off by providing short-term power at extremely high prices.

Adani's competitors lined up to supply the people of Gujarat cheaper, long-term electricity but their tenders were blocked by the power authority. This resulted in massive price-hikes and ensured the only energy available was the highly expensive, short-term supply provided by Adani.

Adani's competitors subsequently brought litigation against the power authority for the price-gouging.

In 2014, Adani was found guilty of using its dominant market position to impose unfair conditions on gas customers. They were ordered to change their gas supply contracts and pay $4.8 million AUD.

IMPLICATIONS FOR AUSTRALIA

Adani has run a long and fallacious moral campaign that the Carmichael mine will bring people out of energy poverty. This argument has been debunked by everyone from expert analysts to India's own Energy Minister, who point out that solar power is already cheaper than imported coal, especially for the many low-income Indians who are still off the grid. But even if the argument were true, Adani's track-record of price-gouging shows that it cannot be trusted to provide affordable power to Indian citizens.

Adani accused of deliberately ripping off taxpayers and laundering money while trading in cut and polished diamonds and gold jewellery

A special investigative unit of the Indian tax department (the Directorate of Revenue Intelligence) spent over a decade investigating Adani for laundering money and dodging $195 million AUD in taxes.

One of the more audacious alleged attempts to dodge taxes and hide the proceeds involved the trade of rough-cut diamonds and gold jewellery. Adani appears to have set up a complex web of front companies specifically to fleece Indian taxpayers by misusing various government export incentive schemes. Adani then attempted to hide its illicit profits by storing imported diamonds in a bond, then re-exporting them at artificially inflated prices.

The overwhelming weight of evidence collected by the Directorate of Revenue Intelligence was upheld in a civil court case, although it was later dismissed when the department actually tried to make Adani pay the money back.

"...it was pernicious and blatant misuse of the provisions of the Scheme...This Court...cannot come to the aid of such petitioners/exporters who, without making actual exports, play with the provisions of the Scheme and try to take undue advantage thereof."

"The ownership structure of the proposed Galilee project, the Carmichael project, is totally opaque ... The fact that the Northern Australia Infrastructure Fund Senator can't actually answer who is the proponent - a basic question - means he shouldn't be offering a billion dollar taxpayer subsidy to an unknown proponent in tax havens. There's no way you can do proper due diligence on that corporate structure."

-Tim Buckley, Institute for Energy Economics and Financial Analysis

Adani's Australian assets lead to tax havens

The Carmichael rail line that Adani are seeking a $1 billion taxpayer loan for, is ultimately owned by an Adani entity operating out of the Cayman Islands, a notorious tax haven. This presents a clear risk that public money will be siphoned offshore with no returns for the Australian taxpayer.

The ownership of the Abbot Point coal port is so shrouded in deception and confusion that it remains unclear who actually owns it.

There are massive discrepancies between what Adani says in India and what it says in Australia about the ownership structure of Abbot Point. But one thing is clear -- Adani is lying to someone.

Accounts lodged in India have removed Abbot Point from a publicly listed Adani company and attributed ownership of the coal port to a private Singapore company, ultimately owned by an Adani family entity in the Cayman Islands. However, Australian financial accounts suggest the listed Indian company retains ownership of Abbot Point.

The absence of correct information about the ownership of Abbot Point may amount to misleading or deceptive conduct.

Dodgy financial statements

Adani's most recent financial report lodged with ASIC did not disclose its immediate parent company and provided no detail about the actual or potential transfer of the ownership or control of Abbot Point from an Indian based Adani entity to one based in Singapore (also a known tax haven).

RISKS FOR AUSTRALIA

Adani are tax dodgers. In 2014-15 Adani paid no tax on $350 million revenue in Australia.

Adani's opaque corporate structure poses another unacceptable risk to investors. If Abbot Point is ultimately owned via Cayman Island entities, it could allow Adani to squirrel away any potential profits into tax havens. Meaning Australia would have allowed Adani to dredge in the Great Barrier Reef World Heritage Area, for literally nothing.

Senator Matt Canavan can't even say which Adani entity Australian taxpayer's money would be going to, but he is still preparing to give Adani a $1 billion taxpayer-subsidised loan.

Adani has previously talked up the potential taxes and royalties governments could get from the Carmichael mine, but companies keen on paying their taxes don't register themselves in the Cayman islands.

Take Action

Take ActionExploiting workers

An explosive Fairfax Media investigation uncovered reports of serious exploitation of Adani's workforce, including the use of child labor and underpaid workers, during construction of a luxury housing project in Gujarat.

Read more here Labourers were forced to live in makeshift houses with dirt floors, no running water, and no toilets. The sanitary conditions were so dismal that workers suffered several outbreaks of cholera from contaminated drinking water.

Adani's workers were underpaid and overworked. Almost a quarter were paid less than the minimum wage of $4 a day, and some were not paid at all -- Adani forcing them to wait for months to get paid, while they lived on a pathetic $9 a week 'food allowance'.

A 12 year old boy said he was paid about $2.60 a day to carry water to the labourers for 12 hours a day, six days a week.

Adani avoided complying with state and federal laws by outsourcing their labour to multiple contractors.

Deaths in power plants

In 2016 a hot water pipeline burst at Adani's coal fired power plant in Mundra, burning 21 workers. Seven of whom later died as a result of their injuries.

Read more hereThere have been several reports of accidents and deaths at another Adani power plant in Tirora which suggest the safety standards are very lax. In September 2014 a worker was killed in a blast, and just a few months later another worker was killed after a structure collapsed while air-conditioning units were being installed.

Read more here. In 2012 another labourer was killed and two others critically injured after being trapped under falling pipes.

Read more here.RISKS FOR AUSTRALIA

Adani clearly has a corporate culture that shows no regard for worker safety. Work safety standards at coal mines in Australia also clearly aren't high enough, as evidenced by the current outbreak of black lung amongst coal workers in Queensland.

This isn't a company that has a chequered past, or a slightly blemished record. This is a company which has proven itself corrupt, destructive and deceitful to its core.

It has no regard for its own workers or the law, much less the environment or the local communities it works in. It operates with a vicious mentality where human or environmental damage are par for course.

The agreements and commitments it makes appear worthless. This is a company that doesn't hesitate before breaking the law, contract conditions or moral boundaries in its reckless pursuit of profit.

Adani's proven track record of environmental destruction, human rights abuses, corruption and illegal dealings should sound a stern warning for any government looking to do business with Adani.

And with an open cut coal mine that risks precious groundwater, the habitat of endangered species and the World Heritage Great Barrier Reef, working with Adani would defy all learning and and semblance of good judgement.

Take Action

Take Action